Bookkeeping

Legal Services Accounting: Law Firm COA Template & Account Hierarchy

This is a contributing factor of why the general accounting principles (GAAP) does not find cash accounting acceptable. It can also be complicated to switch from cash accounting to accrual accounting. Some controllers have the expertise to help with daily accounting tasks, but their function mainly lies in overseeing your law firm chart of accounts company’s finances and accounting at a high level.

- This helps in grouping up the details of all the different accounts which would otherwise have been scattered.

- Managing a law firm chart of accounts and general ledgers involves numerous transactions, strict regulatory requirements, detailed reconciliation needs, and accurate financial reporting.

- Using outdated tools, employing multiple platforms, or attempting to do everything manually with spreadsheets can lead to errors and compliance issues.

- In a simpler term, a chart of account is the generalized list of all the accounts that an organization, company, institute or an individual has.

- Every law firm has a responsibility to stay compliant with ethics regulations, and your firm is no exception.

- Journal entries record the day-to-day financial activities of your business.

Top Legal Jobs Placement and Recruitment Agencies in London, UK

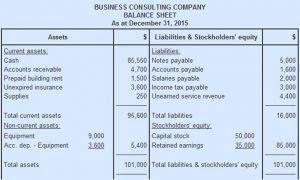

Accounting for law firms is the process of recording and managing a firm’s financial activities. For example, this includes tracking income, expenses, overseeing trust accounts, and monitoring client billing. It also encompasses creating and managing budgets, producing financial reports, and managing payroll. The initial step in setting up a law firm’s accounting system is to establish a law firm chart of accounts.

Chart of Accounts Maintenance Template

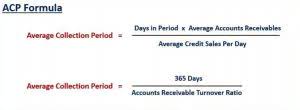

When clients are slow to pay or don‘t pay their bills, you may find yourself unable to pay your staff or cover other overhead expenses. At least once a month, review your receivables and follow up on outstanding client invoices to keep your cash flow strong. Accounts receivables, also known as A/R, are amounts owed to you by clients.

Is a chart of accounts limited?

- A chart of accounts holds immense significance for any law firm, serving as a fundamental tool for effective financial management.

- Regularly reviewing and updating the Chart of Accounts is crucial to ensuring alignment with the firm’s evolving financial requirements.

- By downloading this sample you will be able to understand the structure of such descriptive account charts.

- Reference it as a guide and adjust as needed to reflect your firm’s financial situation.

- This article is purely information and applies specifically to U.S. practices.

- While the chart of accounts is customized to your law firm’s size, jurisdiction, and practice area, it typically includes five core categories in addition to numerous subcategories.

While the chart of accounts is customized to your law firm’s size, jurisdiction, and practice area, it typically includes five core categories in addition to numerous subcategories. Assign a unique account number to each Bookkeeping for Chiropractors account in your chart of accounts. This number will make it easier to reference specific accounts when recording financial transactions.

Bookkeeping vs. accounting for law firms

Our approach involves developing a tailored COA that effectively serves a law firm’s unique requirements. Provided below is a sample of a customized chart of accounts optimized for a family law practice. Law firms, like any other business, require effective financial management to ensure stability, growth, and long-term success. One key tool in managing finances is the Chart of Accounts (COA), a systematic and organized way to record and track financial transactions.

Use software such as Clio Manage to help track your billable time, expenses and revenue. Additionally, keep your financial records in check by syncing to a system for accounting for law firms like QuickBooks Online. To ensure your firm’s financial statements are accurate, complete, and up-to-date, you need to use sound bookkeeping for attorneys. To set up an accounting system that supports compliant financial management, you need specialized tools and applications.

Clio Manage: For legal practice management that supports accounting for law firms

By addressing these requirements from the outset, your chart of accounts becomes a powerful tool for financial management and decision-making. When setting up your chart of accounts, be sure to pay special attention to your handling of trust liability accounts to fixed assets ensure you are keeping accurate records and following the rules. You can track trust bank accounts—like your IOLTA or pooled trust accounts and separate interest bearing trust accounts—on your law firm chart of accounts.